What Is CD (Certificate of Deposit)

What is CD (Certificate of Deposit)?

✍: FYIcenter.com

![]() CDs (Certificate of Deposits) refer to term deposit products

offered by commercial banks or credit unions offered to US investors.

CDs are low-risk and provide fixed incomes.

CDs (Certificate of Deposits) refer to term deposit products

offered by commercial banks or credit unions offered to US investors.

CDs are low-risk and provide fixed incomes.

Main features of CD products:

- FDIC Insured - The principal (up to $250,000 per depositor per bank) is insured by FDIC (Federal Deposit Insurance Corporation), for its member banks.

- NCUA Insured - The principal (up to $250,000 per depositor per credit union) is insured by NCUA (National Credit Union Administration), for its member credit unions.

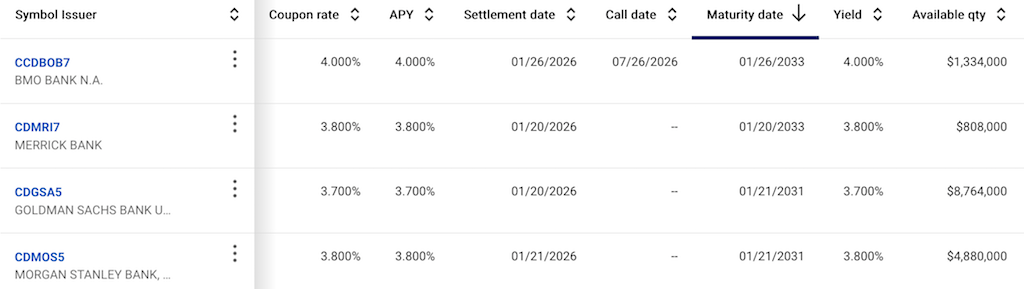

- Brokered CDs - Some CD products are marketable, so you can buy and sell them in units of $100.00.

- Callable CDs - Some brokered CDs are callable, so offering banks can redeem them before their maturity dates.

- Early Withdraw Penalty - If you withdraw money from the CD before maturity, you are subject a penalty, usually interest from last 3 months.

- Wide Range of Terms - Terms of CD range from 3 months to

Here are some examples of long-term CDs:

⇐ Introduction to CD (Certificate of Deposit)

2026-01-18, ∼140🔥, 0💬