T-Bill "Yield" Calculation on Fidelity Investments

How "Yield" of US Treasury Bill is calculated on Fidelity Investments quoting system?

✍: FYIcenter.com

![]() If you are using Fidelity Investments brokerage account to buy or sell

US Treasury Bills, you will see a list of current bidding (and asking)

prices and yields provided by the Fidelity Investments quoting system.

If you are using Fidelity Investments brokerage account to buy or sell

US Treasury Bills, you will see a list of current bidding (and asking)

prices and yields provided by the Fidelity Investments quoting system.

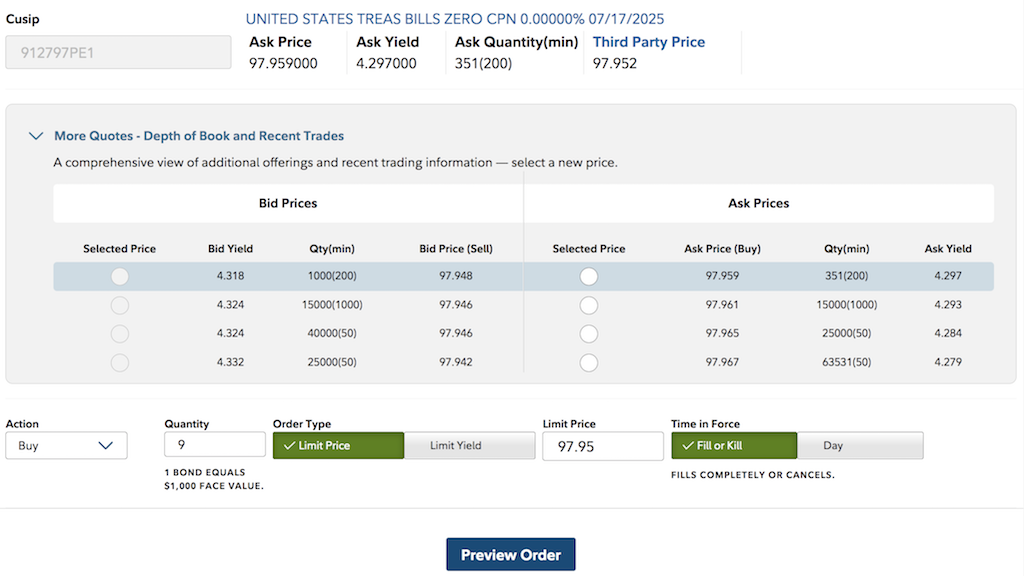

Here is a screenshot of trade order placed on 2025-01-17 to buy a US Treasury Bill:

CUSIP: 912797PE1 Description: UNITED STATES TREAS BILLS ZERO CPN 0.00000% 07/17/2025 Maturity: 2025-07-17

The term "Yield" on Fidelity system represents BEY (Bond Equivalent Yield) defined as:

Note that if the T-Bill is maturing in less than or equal to one half-year, the compounding interest should be replaced by a simple interest.

To verify "Yields" displayed on the Fidelity system, we can use our T-Bill online calculator to convert yields (BEY - Bond Equivalent Yields) to prices. The results are listed below:

Buyer's Quotes | FYIcenter.com

Bid Yield Qty (min) Bit Price | BEY/Yield Discrepancy

--------- ----------- --------- | --------- -----------

4.318 1000(200) 97.948 | 4.3202 -0.0022

4.324 15000(1000) 97.946 | 4.3245 -0.0005

4.324 40000( 50) 97.946 | 4.3245 -0.0005

4.332 25000( 50) 97.942 | 4.3331 -0.0011

Seller's Quotes | FYIcenter.com

Ask Price Qty (min) Ask Yield | BEY/Yield Discrepancy

--------- ----------- --------- | --------- -----------

97.959 351(200) 4.297 | 4.2965 0.0005

97.961 15000(1000) 4.293 | 4.2922 0.0008

97.965 25000( 50) 4.284 | 4.2836 0.0004

97.967 63531( 50) 4.279 | 4.2793 -0.0003

As you can see the discrepancies are bigger than rounding differences except for the last two. So Fidelity is not really using the BEY (Bond Equivalent Yield) formula to calculate the bidding or asking yields.

Since Fidelity is not publishing their "Yield" formula, we don't know how Fidelity is actually calculating "Yields".

⇒ Online Resources on US Treasury Bill

⇐ Buy/Sell US Treasury Bills with Fidelity Investments

2025-05-17, ∼494🔥, 0💬