Non-competitive Bidding of US Treasury Note

What is Non-competitive Bidding of US Treasury Note?

✍: FYIcenter.com

![]() There are actually two main ways to bid T-Notes at US Treasury auctions:

competitively bidding and non-competitively bidding.

There are actually two main ways to bid T-Notes at US Treasury auctions:

competitively bidding and non-competitively bidding.

1. Competitive Bidding - As a bidder, you specifies the yield you are willing to accept. Your bid may be:

- Accepted in the full amount you want if the rate you specify is less than the highest yield set by the auction.

- Accepted in the full or partial amount you want if your bid is equal to the highest yield.

- Rejected if the rate you specify is higher than the highest yield set at the auction.

Competitive Bidding is mostly used by institutional investors.

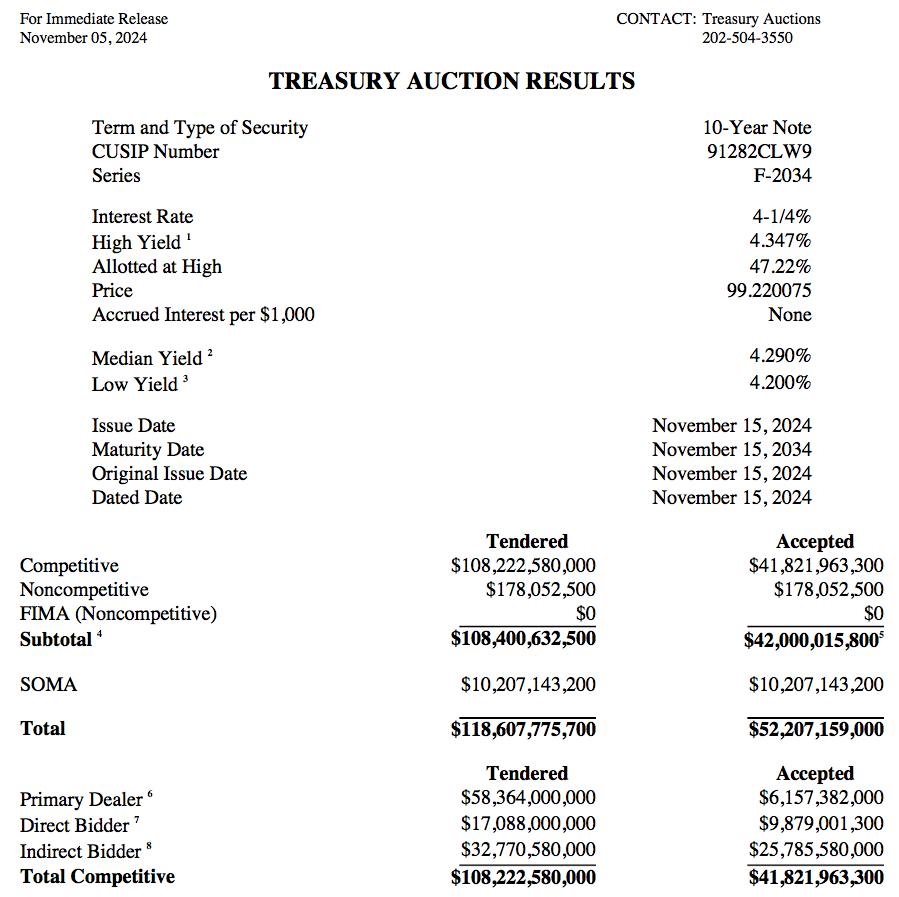

The picture below shows the competitive bidding result of T-Note 912797MV6 original auction on 2024-11-05:

2. Non-Competitive Bidding - As a bidder, you specifies the full amount (par or face value) only. And you agree to accept the highest yield determined at auction. With this bid, you are guaranteed to receive the T-Note you want, and in the full amount you want.

Non-Competitive Bidding is mostly used by individual investors.

The picture below shows the non-competitive bidding result of T-Note 912797MV6 original auction on 2024-11-05:

⇒ Buy US Treasury Notes on TreasuryDirect.gov

⇐ Reopening Auction of US Treasury Note

2025-05-19, ∼315🔥, 0💬