What Is CD (Certificate of Deposit)

What is CD (Certificate of Deposit)?

✍: Guest

![]() A CD (Certificate of Deposit) is a term deposit offered by banks and credit unions,

paying a fixed interest rate for a specified term.

A CD (Certificate of Deposit) is a term deposit offered by banks and credit unions,

paying a fixed interest rate for a specified term.

There are 2 types of CDs: Bank CD and Brokered CD:

1. Bank CD - A bank CD is a special saving account offered by a bank. It typically has a fixed interest rate for a fixed deposit term. You can invest a bank CD by opening a CD account at the offering bank and making a deposit.

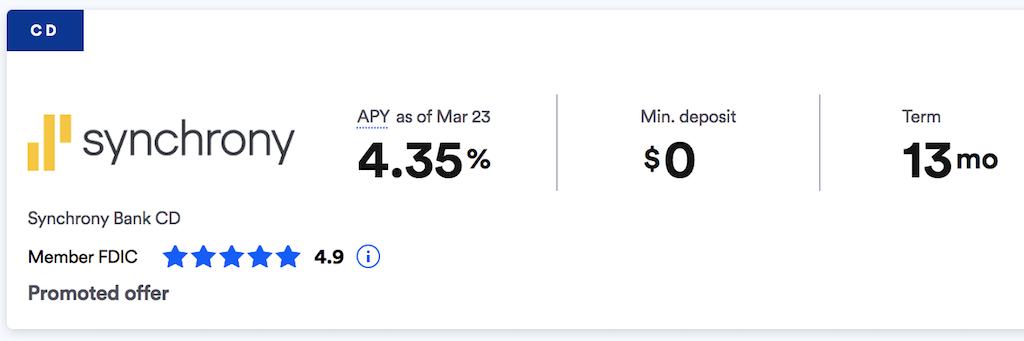

Here is bank CD example offered by Synchrony Bank:

Offering Bank: Synchrony Bank Term: 13 Months Interest Rate: 4.35% Minimum Deposit: $0.00

2. Brokered CD - A brokered CD is a special debt indirectly offered by a bank through an investment brokerage firm. It typically has a fixed interest rate with a fixed issue date and a fixed maturity date. You can invest a brokered CD by purchasing some shares of the debt in your brokerage account at the current market price.

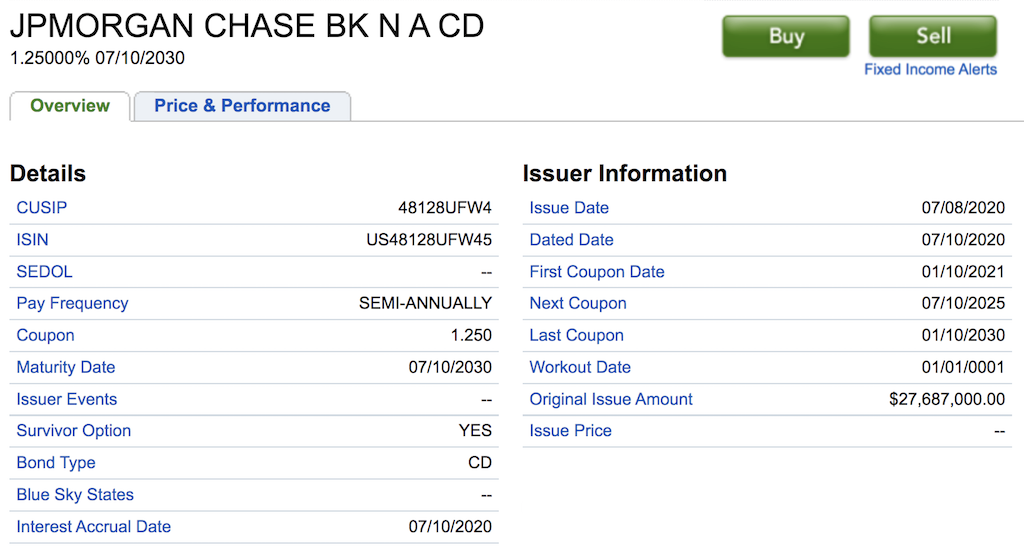

Here is Brokered CD example offered by JPMorgan Chase Bank through Fidelity Investments:

Offering Bank: JPMorgan Chase Bank Broker: Fidelity Investments Term: 10 Years Interest Rate: 1.25% Issue Date: 07/10/2020 Maturity Date: 07/10/2030 Minimum Investment Amount: $10,000.00

⇒ Differences between Bank CD and Brokered CD

⇐ Introduction on CD (Certificate of Deposit)

2025-03-24, ∼282🔥, 0💬