Buy/Sell US Treasury Bills with Fidelity Investments

How to buy or sell US Treasury Bills with Fidelity Investments?

✍: Guest

![]() If you have a brokerage account with Fidelity Investments,

you can follow these steps to buy or sell Treasury Bills.

If you have a brokerage account with Fidelity Investments,

you can follow these steps to buy or sell Treasury Bills.

1. Login to your brokerage account.

2. Select "Research > Fixed Income" from the menu. You see the fixed income security search screen.

3. Select "Bonds" as the security search type.

4. Select "Yields" as the security display type.

5. Select a maturity date column (e.g. "6mo") in the "U.S. Treasury" row. You see a list of Treasury Bills, Notes, Bonds that are maturing in about 6 months.

6. Select "Buy" or "Sell" on a Treasury Bill. You see a list of current quotes on the selected Bill, followed by a trade form to place an order.

7. Fill the trade form, for example:

Action: Buy or Sell Quantity: 9 (in unit of $1,000 face value) Order Type: Limit Price Limit Price: 97.95 Time in Force: Fill or Kill

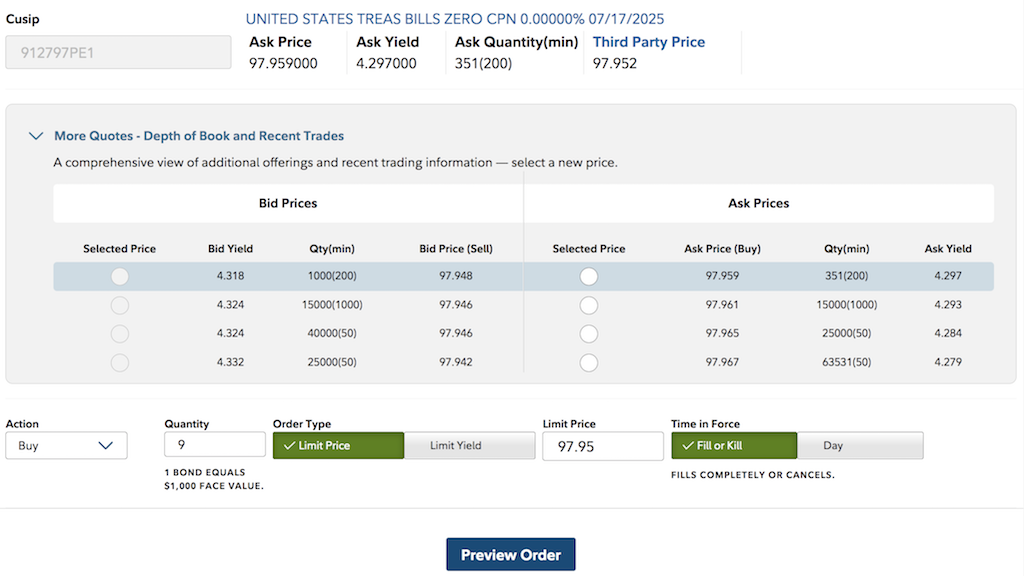

Here is a screenshot of trade order form to buy a US Treasury Bill with your brokerage account on Fidelity Investments.

To help you placing a trade order on a US Treasury Bill, the order form displays detailed information about the Bill:

CUSIP: 912797PE1 Description: UNITED STATES TREAS BILLS ZERO CPN 0.00000% 07/17/2025 Maturity: 2025-07-17

It also displays quotes on the Bill placed by seller/buyers on the stock market at this moment around 4pm on 2025-01-17:

Buyer's Quotes | Seller's Quotes

Bid Yield Qty (min) Bit Price | Ask Price Qty (min) Ask Yield

--------- ----------- --------- | --------- ----------- ---------

4.318 1000(200) 97.948 | 97.959 351(200) 4.297

4.324 15000(1000) 97.946 | 97.961 15000(1000) 4.293

4.324 40000( 50) 97.946 | 97.965 25000( 50) 4.284

4.332 25000( 50) 97.942 | 97.967 63531( 50) 4.279

Note that "Yield" values in the quotes are calculated as BEY (Bond Equivalent Yield) values, and settlement dates are 1 business day after purchase dates.

You can also use our T-Bill online calculator to convert BEYs (Bond Equivalent Yields) to purchase prices. For example, click this link "T-Bill 912797PE1 settled on 2025-01-21 with an asking price of $97.959", you will see the asking yield of 4.2965% displayed.

Note that the purchase date, 2025-01-17, was a Friday in the above example. And the next Monday was a holiday in US. So the settlement day was the next Tuesday, 2025-01-21.

Also note that the asking yield of 4.2965% converted by our tool is slightly lower than 4.297% on the Fidelity quote table. See next tutorial for more details on this discrepancy.

⇒ T-Bill "Yield" Calculation on Fidelity Investments

⇐ Buy US Treasury Bills on TreasuryDirect.gov

2025-01-20, ∼983🔥, 0💬