What Is US Fed Discount Rate

What is US Fed Interest Rate?

✍: FYIcenter.com

![]() US Fed Discount Rate, also referred as Fed Interest Rate,

is the interest rate the Federal Reserve charges commercial banks

when they borrow money directly from the Federal Reserve.

Loan values are discounted upfront to compensate interests when given to borrowing banks.

The Fed Discount Rate is reviewed and published every 6 weeks by the Federal Reserve Board.

US Fed Discount Rate, also referred as Fed Interest Rate,

is the interest rate the Federal Reserve charges commercial banks

when they borrow money directly from the Federal Reserve.

Loan values are discounted upfront to compensate interests when given to borrowing banks.

The Fed Discount Rate is reviewed and published every 6 weeks by the Federal Reserve Board.

Fed Discount Rate is for short-term loans only, from overnight (1 day) to 90 days.

The practice of providing short-term loans to commercial banks is often called the Fed Discount Window, because back in the old days, bank representatives have to physically go to a teller window at a Federal Reserve Bank branch to request short-term loans.

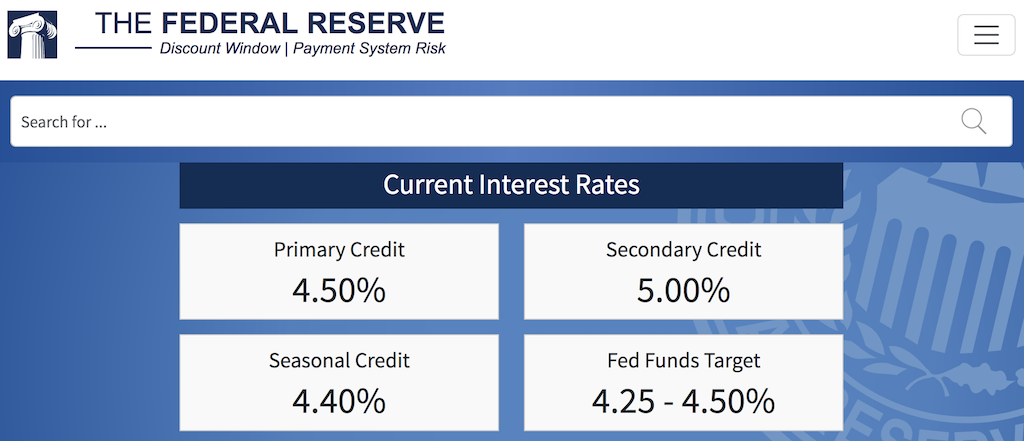

Federal Reserve actually publishes 3 Discount Rates. If you go to this Federal Reserve Website as of Jan 1, 2025, you will see:

- Primary Credit: 4.50% - Fed Discount Rate for commercial banks with primary credits to borrow money. This rate is commonly referred as Fed Interest Rate.

- Secondary Credit: 5.00% - Fed Discount Rate for banks with secondary credits to borrow money.

- Seasonal Credit: 4.40% - Fed Discount Rate for banks with seasonal credits to borrow money.

Note that Fed Funds Target on screenshot refers to Fed Funds Rate, which applies to short-term loans between commercial banks.

Recently published US Fed Discount Rates for banks with primary credits are:

Rate Publish Date ----- ------------ 4.50% 19-Dec-2024 4.75% 08-Nov-2024 5.00% 19-Sep-2024 5.50% 27-Jul-2023 5.25% 04-May-2023 5.00% 23-Mar-2023 4.75% 02-Feb-2023 4.50% 15-Dec-2022 4.00% 03-Nov-2022 3.25% 22-Sep-2022

⇒ Historical Values of Fed Discount Rates

⇐ Introduction to US Interest Rates

2025-01-23, ∼619🔥, 0💬